Kevin Warsh as Fed Chair a Wildcard for U.S. Central Banking

Donald Trump is at it again. His consideration for Kevin Warsh as Fed Chair threatens to disrupt a century-old institution that is not used to disruption. Both the left and right are actively lobbying against his admission, which speaks volumes about the catalyzing force Kevin Warsh presents.

But who is Kevin Warsh and what exactly does he stand for anyway? These are critical questions to consider when contemplating what a Warsh-led Federal Reserve might look like. Despite some resistance on both sides of the aisle, deficit hawks could be wringing their hands in glee.

As for Warsh’s distinguished academic and professional background, we won’t go too in-depth. After all, when you reach these levels of hallowed financial elitism, everybody has an impeccable Ivy-League resume. However, Kevin Warsh holds a distinction no other Federal Reserve Board member has: at 35, he’s the youngest appointee in Fed history.

It’s Warsh’s actions as Fed Board member that are more relevant to the conversation. If he follows the same type of policy initiatives, as real shake-up mainstream Fed ideology may be in order.

Specifically relevant are Warsh’s comments in 2010 as the U.S. was recovering from the Great Recession. With unemployment at 9.4% and inflation very tame at 1.3%, Warsh vociferously argued against a second round of bond purchases designed at lowering long-term interest rates. He did this despite the fact that the Fed’s benchmark policy rate had been near-zero for almost two years. (Source: “Fed Chair Candidate Kevin Warsh Draws Opposition From Left and Right,” Bloomberg Politics, October 4, 2017.)

So this fact alone suggests Kevin Warsh is hawkish towards deficit spending as a way to stimulate the economy. It also shows Warsh was deeply concerned about inflation as a result of the monetary base expanding (ultimately proven untrue) As “Fed Independence” author Mark Spindel put it, “He seemed to be fighting for less, not more during the crisis.” (Source: Ibid.)

This may be the reason why liberal Keynesian economists, like Paul Krugman, are virulently trying to steer Trump in a different direction. The neo-Keynesian worldview of economic policy states that stimulus should provide to boost economic growth—especially in times of crisis. An exploding deficit is way down on the list of considerations.

Another point of consideration: Kevin Warsh is quoted a saying that Fed policy isn’t “working” for the economy and that the Fed is a “slave” to the stock market. Both views are likely to excite non-interventionalists (Austrian economists) who believe Fed liquidity is distorting markets and propping up “too big to fail” corporations which are zombifying the economy.

Will Donald Trump Pick Kevin Warsh?

The odds of Kevin Warsh as fed chair continue to grow. As of October 2, 2017, Warsh was a 33% favorite to succeed incumbent Janet Yellen according to the0 “PredictIt” probability market. In second place was Jerome Powell with 26%, and Janet Yellen at 17%. (Source: “Favorite to be next Fed chair believes central bank is a ‘slave’ to the stock market,” CNBC, October 2, 2017.)

Given the Kevin Warsh Trump connection by way of Ronald Lauder, the advantage may be even greater. Kevin Warsh is the son-in-law of Ronald Lauder, who is a good personal friend of Trump. Warsh is also married to Jane Lauder, an heiress of the Estee Lauder Companies Inc (NYSE:EL) cosmetics empire. The personal connections run deep.

The one missing piece in the equation is Trump’s proclivity for debt spending. Given Trump’s reputation as the “King of Debt,” and the ambitious infrastructure and tax reform plans (both requiring huge increases in deficit spending), would a Kevin Warsh-led Fed be dovish enough?

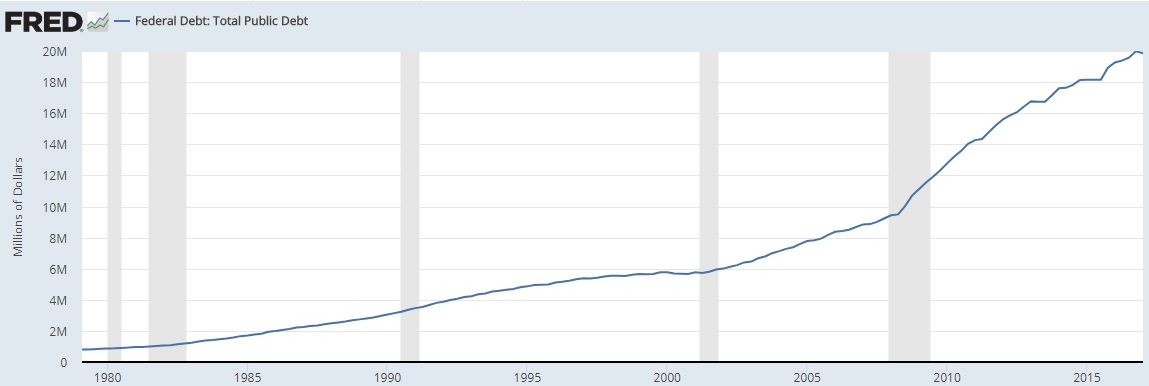

(Source: “Federal Debt: Total Public Debt,” Federal Reserve Bank of St. Louis, last accessed October 5, 2017.)

For example, would Warsh be obliged to launch a quantitative easing-like program if the economy hits recession? Would Warsh seek to pull back conciliatory policies regarding asset price support? We all know how Trump loves to equate the record highs in stock markets as “winning.”

But then again, Trump has disrupted conventional establishment policy and thought before. Appointing Kevin Warsh would simply be an extension of what Trump has consistently done. Many would argue a decisive change in direction is exactly what this staid old institution needs.

We shall find out soon enough. The next Federal Reserve chairman appointment must come before February 3, 2018, when Janet Yellen’s term comes to a close.